The domestic stock market should brace for up to 30 per cent drop in cash and derivative market volumes in the next six months due to the new peak margin rules, warns Nikhil Kamath, Co-founder of Zerodha.

The new margin rules that came into effect from December 1 stipulates 25 per cent peak margin. This has already led to a drop in volumes. And the co-promoter of India’s largest brokerage says this volume drop will be sharper when the margin requirement is doubled to 50 per cent from March, 2021, and 75 per cent from June. From September 1, the margin requirement will be 100 per cent.

“Right now, it is not making a big difference because they only want 25 per cent of peak margin for the first three months since December 1. Once this peak margin rises, the drop in volume can rise to 25-30 per cent,” Kamath said in an exclusive interview with ETMarkets.com.

In December, the average daily trading volume has dipped marginally. In the cash market segment, it has come down to 350 crore shares on NSE from about 389 crore in the previous month. In equity futures, the daily average number of contracts has dropped to 8,09,232 from 10,37,593 in November.

“We were always conservative as a broker. We realised early that more leverage does not help the client, but hurts her. We have always provided a rational amount of margin and not the excessive 30-40 times that some other brokerages offer. So the new rule has affected us less than the rest of the industry. The hardest hit are those who were not doing the right thing to begin with. You cannot allow a retail guy have Rs 50,000 to buy equity worth Rs 20 lakh intraday and expect him to make money,” Kamath said.

He, however, believes a lot more activity will now move towards the options segment. For now, the volume and turnover has remained more or less the same compared with that in November, NSE data showed.

In December so far, the number of average daily contracts stood at 3.44 crore against 3.45 crore in November. The corresponding option premium turnover stood at Rs 12,949 crore against Rs 13,445 crore.

No sense in buying shares

As the shares have rallied relentlessly in the past nine months, valuations have reached scary levels. And Kamath thinks buying shares at astronomical valuations does not make sense.

“Stocks are too expensive right now. The market is more expensive than it has ever been. People are pushing money. Plus a lot of western countries are printing money, which is finding its way to India. You can’t predict when this will end,” said Kamath, who also runs an alternate investment fund True Beacon.

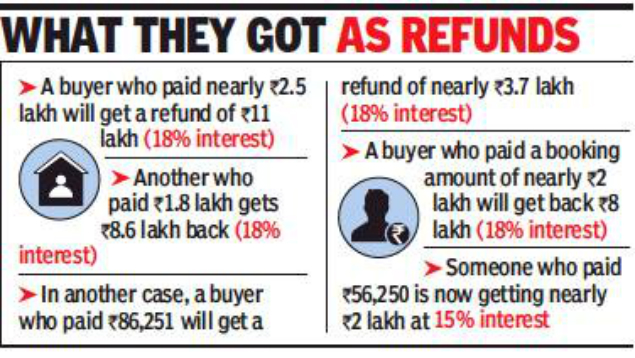

He, however, said people have run out of other options to invest in and more money is headed for the market. “Bank fixed deposits were giving 7-8 per cent returns at one point, but are now giving 4-5 per cent. Residential real estate yields are now at around 2 per cent. People who were earning and saving have to eventually put it somewhere. By that logic, a lot more money will come into the equity market,” he said.

Data available on NSDL shows foreign equity investors have poured Rs 2,12,918 crore in equities for this financial year, which is the highest in last 28 years, the duration for which the data is available. Thanks to that, investors have increased their equity wealth by Rs 86 lakh crore since March lows.

Kamath said the benefits on taxation and ease of withdrawal of money is also drawing people towards equities. “People prefer equity to other asset classes, because it is liquid and the tax on gains from shares held for more than 12 months is 10 per cent. You can access this money any time you want, which is a big selling point,” he said.

No price war between brokers

Kamath said there is no competition among the brokerages in terms of pricing now, as the line between traditional brokerages and discount brokerages has become blurred. In recent months, a number of traditional brokerages like Sharekhan and Kotak Securities have launched discount broking products or simplified their product structures.

“The line has gone. I don’t think there is a difference anymore. Now it will come down to the product, and who has better technology. Price is out of the window. People are no longer competing with price,” said Kamath.

“Our entire USP has been transparency and technology in the last 11 years. What differentiates us from the peers is that we do not have any hidden fees and we are constantly throwing out new products and platforms that help traders become profitable,” he said.

Market outlook conservative

Kamath has a very conservative view on the domestic stock market now and has positioned himself in such a way that if there is a correction of 10 per cent, his fund would not lose more than 3-4 per cent.

“We are running a long-short strategy. We play an arbitrage between companies that are stronger and those which are weaker. So, if Company A is weak and Company B is strong, we will short A and be long on B. At a fund level, we are 57 per cent hedged,” he said.

His conservatism is reflected in his sectoral preferences as well. He is bullish on pharma and IT, which are traditionally regarded as defensive sectors. Incidentally, both sectors have risen the most in 2020.

“Both IT and pharma are good places to hide. They tend to do well when the market becomes volatile. So, we like them at this point,” Kamath said.