Did you know Rao was also referred to as 'Chanakya' for his ability to steer economic and political legislation? Read on to know more.

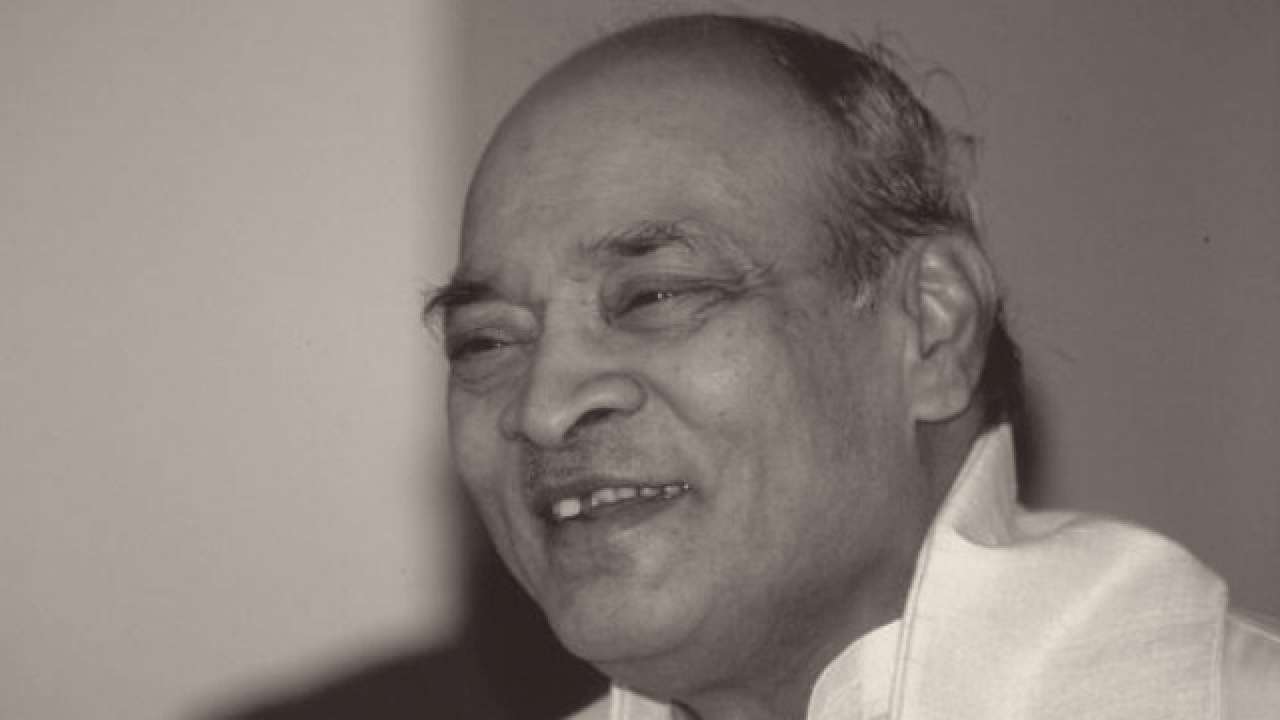

Today, on June 28th, 2020, India is observing the 99th birth anniversary of former Prime Minister Pamulaparthi Venkata Narasimha Rao, popularly known as PV Narasimha Rao. While serving as the ninth Prime Minister of India from 1991-1996, Rao oversaw one of the arguably most tumultuous phases in India's history, especially significant as the person singularly responsible for dismantling the Nehruvian policy of License Raj, thereby reversing the socialist policies of the Rajiv Gandhi government.

Forever debated as one of the most controversial moves, Rao nonetheless left behind a legacy in India's leadership as future Prime Ministers like Atal Bihari Vajpayee and Manmohan Singh continued the economic reform policies pioneered by Rao's government. With PV Narasimha Rao's mandate, Manmohan Singh had launched India's 'globalisation' angle of the reforms that implemented the International Monetary Fund (IMF) policies to rescue the almost bankrupt nation from economic collapse.

Rao was also referred to as Chanakya for his ability to steer economic and political legislation through the parliament at a time when he headed a minority government.

In addition to these, PV Narasimha Rao was also the first Prime Minister from southern India and was also the second one to hold such a post from a non-Hindi-speaking region.

On his 99th birth anniversary, here are five facts about former Prime Minister PV Narasimha Rao that you probably did not know:

He was not just a Prime Minister from a non-Hindi-speaking region, PV Narasimha Rao had also mastered as many as eight Indian languages. Telugu was his mother tongue and he was fluent in Kannada and Tamil as well. In addition to these, Rao had an excellent command over Marathi, Hindi, Oriya, Urdu, Bengali, Gujarati, and even the classical language Sanskrit. Not just these, he could also speak eight foreign languages, including English, French, Arabic, Spanish, German, Greek, Latin, and Persian. Truly a polyglot!

Rao very nearly retired from politics in 1991. It was the assassination of the Congress President Rajiv Gandhi that persuaded him to make a comeback. As the Congress had won the largest number of seats in the 1991 elections, he had an opportunity to head the minority government as Prime Minister. He was the first person outside the Nehru-Gandhi family to serve as Prime Minister for five continuous years, the first to hail from the state of Andhra Pradesh, and also the first from southern India.

Rao energised the national nuclear security and ballistic missiles program, which ultimately resulted in the 1998 Pokhran nuclear tests. He had increased military spending and set the Indian Army on course to fight the emerging threat of terrorism and insurgencies, as well as Pakistan and China's nuclear potentials. It was during his term that terrorism in the Indian state of Punjab was finally defeated.

Rao opened up India's markets to foreign investment, reformed capital markets and trade regime, and deregulated the domestic business. His economic reforms were aimed at averting the impending 1991 economic crisis. During his time, the total foreign investment (including foreign direct investment, portfolio investment, and investment raised on international capital markets) in India grew from a minuscule US$132 million in 1991–92 to $5.3 billion in 1995–96.

Rao had launched the Look East foreign policy, which brought India closer to ASEAN member-nations. This, in turn, led to India's increasing economic interaction with South East Asia and forged important strategic and defense links with several countries in this region.

On his 99th birth anniversary, several politicos cutting across the spectrum, including Prime Minister Narendra Modi and Vice President M. Venkaiah Naidu paid their respects to former Prime Minister PV Narasimha Rao.

Forever debated as one of the most controversial moves, Rao nonetheless left behind a legacy in India's leadership as future Prime Ministers like Atal Bihari Vajpayee and Manmohan Singh continued the economic reform policies pioneered by Rao's government. With PV Narasimha Rao's mandate, Manmohan Singh had launched India's 'globalisation' angle of the reforms that implemented the International Monetary Fund (IMF) policies to rescue the almost bankrupt nation from economic collapse.

Rao was also referred to as Chanakya for his ability to steer economic and political legislation through the parliament at a time when he headed a minority government.

In addition to these, PV Narasimha Rao was also the first Prime Minister from southern India and was also the second one to hold such a post from a non-Hindi-speaking region.

On his 99th birth anniversary, here are five facts about former Prime Minister PV Narasimha Rao that you probably did not know:

He was not just a Prime Minister from a non-Hindi-speaking region, PV Narasimha Rao had also mastered as many as eight Indian languages. Telugu was his mother tongue and he was fluent in Kannada and Tamil as well. In addition to these, Rao had an excellent command over Marathi, Hindi, Oriya, Urdu, Bengali, Gujarati, and even the classical language Sanskrit. Not just these, he could also speak eight foreign languages, including English, French, Arabic, Spanish, German, Greek, Latin, and Persian. Truly a polyglot!

Rao very nearly retired from politics in 1991. It was the assassination of the Congress President Rajiv Gandhi that persuaded him to make a comeback. As the Congress had won the largest number of seats in the 1991 elections, he had an opportunity to head the minority government as Prime Minister. He was the first person outside the Nehru-Gandhi family to serve as Prime Minister for five continuous years, the first to hail from the state of Andhra Pradesh, and also the first from southern India.

Rao energised the national nuclear security and ballistic missiles program, which ultimately resulted in the 1998 Pokhran nuclear tests. He had increased military spending and set the Indian Army on course to fight the emerging threat of terrorism and insurgencies, as well as Pakistan and China's nuclear potentials. It was during his term that terrorism in the Indian state of Punjab was finally defeated.

Rao opened up India's markets to foreign investment, reformed capital markets and trade regime, and deregulated the domestic business. His economic reforms were aimed at averting the impending 1991 economic crisis. During his time, the total foreign investment (including foreign direct investment, portfolio investment, and investment raised on international capital markets) in India grew from a minuscule US$132 million in 1991–92 to $5.3 billion in 1995–96.

Rao had launched the Look East foreign policy, which brought India closer to ASEAN member-nations. This, in turn, led to India's increasing economic interaction with South East Asia and forged important strategic and defense links with several countries in this region.

On his 99th birth anniversary, several politicos cutting across the spectrum, including Prime Minister Narendra Modi and Vice President M. Venkaiah Naidu paid their respects to former Prime Minister PV Narasimha Rao.